Attempting to get the lowest interest you are able to? What appears like a minor difference eventually helps you save significantly more currency, based on how a lot of time your stay-in your property.

Reduced incentives

This really is the obvious benefit of transitioning in order to good 15-seasons home loan. Envision what you are able carry out if for example the home is repaid that much sooner or later! Shortly after lofty wants out of investment your infant’s college tuition, increasing your later years efforts, otherwise to purchase an investment property getting with ease possible.

Drawbacks of good fifteen-12 months financial

Not all borrower is actually a candidate to help you re-finance in order to an excellent 15-season mortgage. Having said that, here are some questions to inquire about your self before extend so you can a lender.

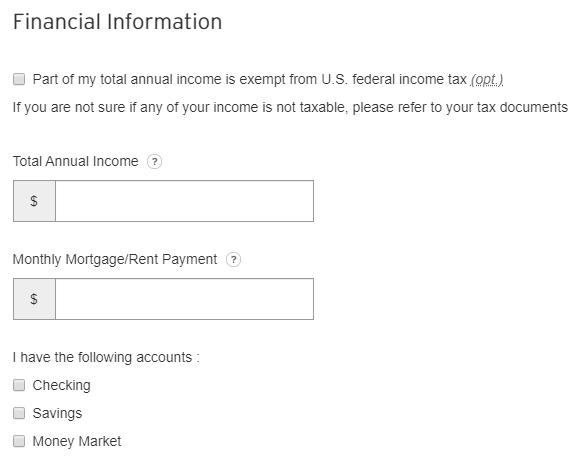

Should i afford the repayments? — Tell the truth with your self: do you really manage earmarking much more money each month to suit your mortgage? Basic, you will want to assess all your economic photo. Is your family income secure sufficient to endure increased percentage? In case the response is sure, be sure to features a checking account that can coverage 3-half a year off costs. A higher portion of your income going to your our house fee helps make a safety net a whole lot more important.

Will i miss out the freedom having equity? — Individuals every where is actually taking advantage of rising home prices having good cash-out re-finance. In a nutshell, it exchange comes to taking out fully a different sort of home loan having a higher amount borrowed and you can pocketing the real difference (part of the collateral) given that bucks. One of many cons out of refinancing to help you an excellent fifteen-season loan is you might not have it quantity of autonomy with your security. Subsequently, there clearly was a high probability you are going to need to turn to personal loans or credit cards to pay for renovations.

Do You will find sufficient money left over for other priorities? — This matter links back again to the latest affordability you to definitely a lot more than. Though everybody’s economic climate is different, just be aware of most of the objective. Instance, will it sound right to lead faster so you’re able to later years accounts so you’re able to re-finance to a beneficial fifteen-12 months financial? Similarly, will you be comfortable investing additional hundreds of dollars or more every few days into the your own home loan whether your wet big date financing isn’t somewhat in which you want it to be?

Will i lose particular tax gurus? — Remember concerning home loan desire tax deduction you have be used to to help you with a 30-12 months mortgage. Paying off your own mortgage in half the full time entails you’ll be able to cure so it deduction ultimately. Think talking to a tax elite group when you’re concerned about just how a beneficial fifteen-seasons mortgage could impact the taxation responsibility down the road.

15-12 months home loan compared to. 30-12 months mortgage

There are lots of reasons why the typical Western resident prefers an excellent 30-season financial. For one thing, it permits to possess better financial autonomy. The lower payment gives individuals the chance to make guarantee when you are checking up on other loans repayments and you may stashing away bucks getting a crisis.

The ideal candidate for a fifteen-year financial usually inspections a couple packets: he has a constant job and no big debt obligations. Because individual are able to afford the greater payment per month, they would not be wise so they can spend an additional fifteen years’ property value appeal. However, perform they https://paydayloanalabama.com/hobson/ be much better of nevertheless which have a thirty-season loan by relevant tax deductions?

At the same time, good applicant having a thirty-year home loan could have the common or slightly below-mediocre money. In the place of individuals who are able to afford a fifteen-seasons label, these individuals normally do not have the information to manage a good rather highest mortgage repayment. These individuals are apt to have a number of other monetary requires and you may personal debt instance paying down student education loans or performing children.

Нет Ответов