Into the a residential property, understanding the some financing solutions can also be rather change the to get and you can selling procedure. One such option, will skipped but highly beneficial in specific products, is the assumable home loan. In this post, we will have just what a keen assumable home loan was, the way it operates, the pros and restrictions, and you can whether it could be the right choice for you.

Get the Advantage with our support program

A keen assumable financial is a type of mortgage enabling the buyer to take over the seller’s established home loan, and their rate of interest, repayment several months, and terms. This transfer out-of home loan responsibility might be a strategic move around in a changing interest ecosystem. Unlike traditional mortgage loans, where buyer need safe a special loan, assumable mortgage loans provide high benefits, especially if interest rates features risen given that new financing try applied for.

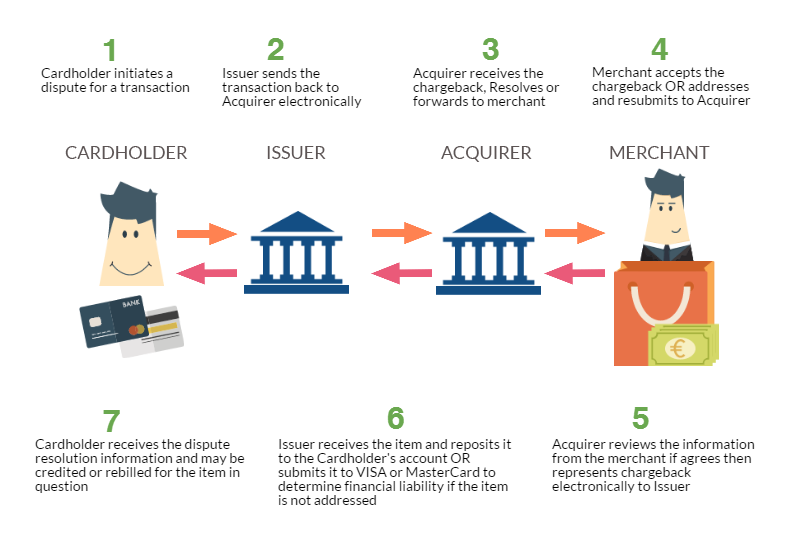

How does an Assumable Mortgage Works?

- 1st Contract. The customer and you will seller agree totally that the consumer commonly suppose the fresh existing financial.

- Financial Acceptance. The mortgage financial must approve the loan expectation, making sure the consumer fits its borrowing and you can economic conditions.

- Legal and you may Economic Duties. Just after approved, the customer takes over the brand new monthly installments or any other loans related into the mortgage. Owner is generally released out of liability, no matter if this may will vary predicated on lender principles.

Both sides should be aware of the requirements in this process. The seller must provide every expected financial details and you will helps telecommunications on financial. The buyer have to be ready to proceed through a comprehensive borrowing from the bank and bad credit personal loans Oregon you will monetary review by the lender.

Version of Assumable Mortgages

In terms of assumable mortgage loans, its necessary to understand the various sorts offered in addition to their particular requirements, professionals, and you may constraints. Right here, we shall talk about the new five number one kind of assumable mortgage loans: FHA, Virtual assistant, USDA, as well as the rare antique finance that come with assumable clauses.

FHA Assumable Mortgage loans

Government Property Government (FHA) money are recognized for are so much more accessible to borrowers because of their lenient borrowing requirements and you can low down payments. These characteristics as well as stretch to their assumable mortgage loans.

Criteria to own Assuming an FHA Financing. To assume a keen FHA financial, the consumer need certainly to meet with the FHA’s creditworthiness criteria, and this usually setting that have a decent credit score, a reliable source of income, and a manageable financial obligation-to-earnings ratio. The buyer might also want to show that they can shelter the difference between the property’s deals rate and also the an excellent financial balance, will demanding a substantial down payment.

Experts and you may Constraints. The main advantageous asset of while an enthusiastic FHA mortgage is the potential to possess straight down interest levels as compared to current market prices. Simultaneously, FHA loans are easier to be eligible for than conventional loans, which makes them a stylish option for customers which have down credit scores. Another advantage ‘s the prospective cost savings, just like the assumable FHA finance can aid in reducing closing costs compared to taking aside a different sort of mortgage.

Yet not, there are constraints. The home have to see particular FHA conditions, that can encompass additional monitors and appraisals. Additionally, whether your loan’s equilibrium is significantly lower than new property’s newest worth, the consumer may require a considerable deposit or additional resource.

Va Assumable Mortgage loans

The new Agencies away from Pros Factors (VA) also offers loans in order to services participants, experts, and you can eligible surviving partners, providing them with multiple advantages, in addition to assumability.

Qualification Standards to own Just in case a beneficial Va Mortgage. Both pros and you can low-pros can suppose a great Virtual assistant mortgage, nevertheless the process involves the lender’s recognition. The customer need certainly to meet with the lender’s borrowing and you can financial standards. Notably, the newest seasoned vendor can be win back its full Virtual assistant mortgage entitlement merely if for example the visitors is even a veteran which substitutes the entitlement.

Нет Ответов