- The effective use of our home because a first household, rather than a residential property

Of several deposit direction applications try across the country. Consequently while a recently available Arizona resident seeking to escape regarding state, many choices arrive. There are even numerous information to possess when you look at the-condition just use. Within a more granular height, specific apps are available in specific places otherwise counties.

USDA home loans

Brand new USDA techniques involves the conventional actions from using, underwriting, and investing settlement costs. Such funds have become useful in being qualified outlying parts and also for more youthful, first-big date homeowners.

USDA loans offer no cash off from the time of closure, aggressive interest levels, low home loan insurance rates (paid down monthly), and you may lenient and flexible credit qualifications. Homebuyers need to be Us citizens that will inform you consistent earnings and you will the ideal debt so you’re able to income ratio.

Virtual assistant mortgage brokers

So you can be eligible for an excellent Va home loan, buyers need certainly to implement through the Department regarding Experts Things. Basically, this type of funds try arranged getting energetic obligation service users, pros, partners, and you will qualifying beneficiaries. According to the Virtual assistant procedure, first-go out homeowners meet the criteria for finest mortgage terms and conditions than simply buyers to buy a subsequent home.

Domestic within the Four mortgage brokers

The home inside Five Virtue System was created specifically for reasonable-income some body from inside the Maricopa Condition, Washington. It down-payment guidelines alternative offers 5%, that can wade to the a down-payment and you may closing costs. There are particular conditions that the customer need certainly to satisfy, and you will selected homes also provide a collection of conditions to get to know.

Being qualified public service providers, such as for example K-a dozen educators and crisis responders, is entitled to a lot more dollars benefits from Family within the Four.

Household Together with mortgage brokers

The latest Arizona Domestic Plus home loan system is made for Arizona residents whoever household income is actually lower than $105,291 a year. The application is actually steadily expanding in the prominence which will be meant to let very first-go out homebuyers generate far more household instructions regarding county. The program advertises doing $19,2 hundred during the advance payment recommendations and will be offering flexible home mortgage choice to possess customers of all the financial backgrounds.

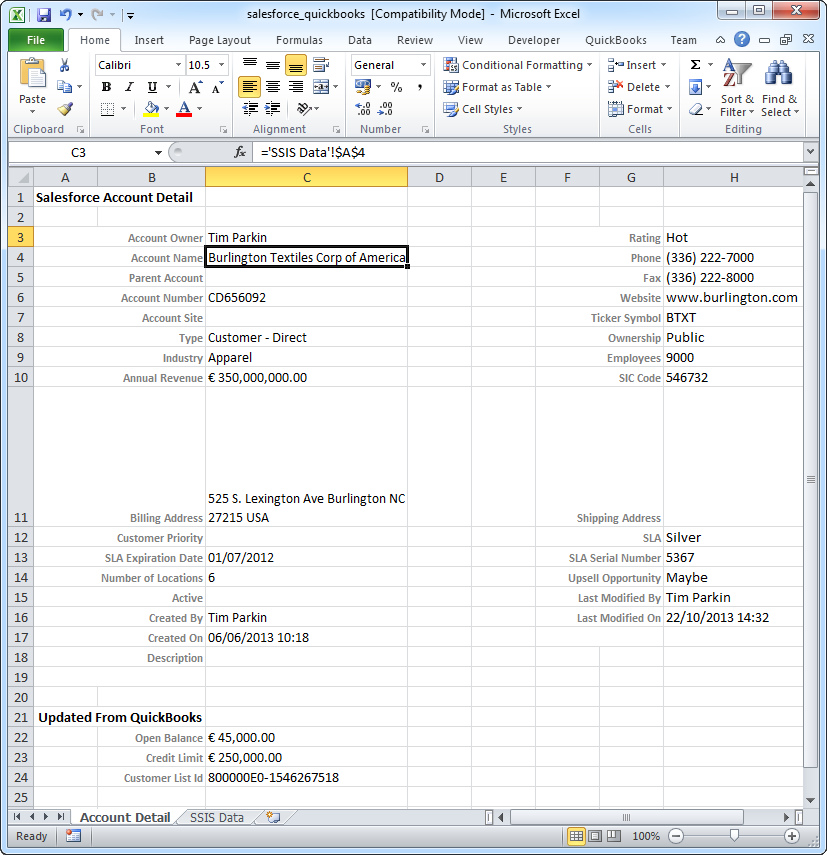

To have Arizona citizens, extent owed in a downpayment try proportional to the level of the house loan. This money amount and additionally varies in line with the types of financing you qualify for otherwise which you see. To possess a precise photo, you will need to enter this particular article into the home financing calculator:

- The price of our home you want to purchase

- The latest portion of the brand new downpayment you intend so you’re able to lead

- The definition of (otherwise size) of the financial in many years

- The pace your qualify for via your chose financial

In turn, the borrowed funds calculator have a tendency to factor in several elements that comprise your general payment. These types of quantity will establish:

- Simply how much you can easily spend within the dominant and you will attention each month

- How much you can easily spend in installment loans online Washington possessions taxation and you can homeowners insurance

- This new projected price of personal financial insurance (PMI)

Mortgage hand calculators can not render a vow out of exacltly what the accurate percentage problem was, however they do give a good 1st step as you browse for belongings and set your financial allowance.

Info getting Washington Homeowners

According to the United states Census Agency, away from 2014-2018, the property owner-filled casing rates into the Arizona is 63.6%. Where exact same time period, Washington home values saw a growth. As a whole, home values and you may average income account are employed in combination so you can train the level of value getting Washington family.

If you are looking to get a home inside Washington and need additional information regarding recommendations, the following resources are excellent places to begin.

Нет Ответов