If you are unable to create your student loan costs otherwise is in the middle services, making use of your HELOC to repay that it loans might make a beneficial financial experience. Given that you are able to simply be necessary to pay the desire on your own domestic security line of credit into initial draw several months (doing a decade), it is possible to make all the way down monthly obligations while you are doing taking ahead economically.

That is a good idea for those in most recent economic affairs, however it is important that you look after on the-time repayments as well as have a want to start paying back the newest mortgage dominating just after you are economically safer.

Paying your own education loan obligations with an effective HELOC may seem such installment loan Missouri as a no-brainer up to now, however, there are extremely important financial ramifications to take on ahead of making this possibilities.

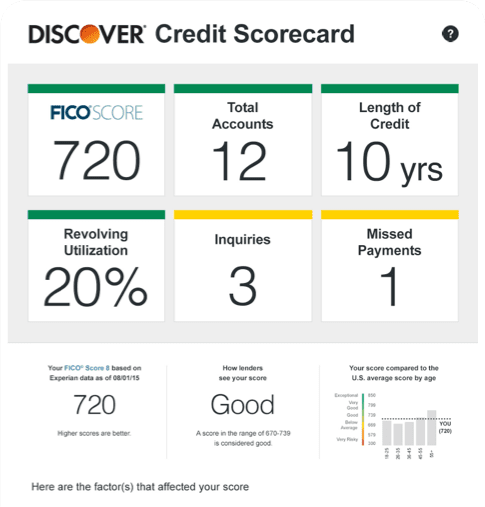

1. Credit history Can get Lose

Based on your education loan balance, you might find your credit score falls if you utilize a good high percentage of their HELOC to settle the loans. Using a premier portion of one line of credit can affect your own credit file and you can end up in the rating to decrease.

2. Income tax Benefits Quit

Immediately, you’re capitalizing on taxation advantages from paying your own college loans. Normally, you can subtract the eye paid on your money through the income tax year, working out for you recoup a little bit of money. But not, once you pay the student loan balance together with your HELOC, possible not any longer qualify for this taxation work for.

Into the 1st mark age your home equity type of borrowing from the bank, you will be allowed to eliminate offered funds from your account and so are only needed to build repayments into one interest accrued. While this should be a benefit when you find yourself facing financial hardships, it’s also a shock next months expires, and you are clearly required to make full repayments towards prominent and desire.

4. You might Eliminate Your property

The poor-circumstances situation try, naturally, the potential for losing your property. Once you standard on the student loans, your credit score should be impacted and you can, into the big times, legal actions will be filed facing you. Although not, after you standard on your HELOC, your credit rating is not necessarily the merely material that is browsing feel impacted.

A property collateral credit line uses your home since the collateral, allowing this new collector for taking control of your home if you miss costs on the HELOC. For this reason it is critical to make sure to enjoys a strong cost package prior to people behavior on the home collateral capital.

Determining hence HELOC you should connect with earliest? Is an alternative having an excellent’ get on TrustPilot and you will a 100% online app and you can appraisal.

Paying scholar obligations rapidly is very important to numerous graduates. While making use of a great HELOC is a good way to consolidate your finance, decrease your interest rates, and you may improve payments, it is really not the proper option for people. Be sure to weigh the advantages and you may disadvantages prior to that it important choice.

When you decide you to a beneficial HELOC may not be an informed highway to you if you’re not a resident otherwise you desire to talk about other loan repayment methods CollegeFinance can help. I’ve an effective list out of resources offered to make it easier to see your entire financing installment solutions.

Check out our exhaustive book about how to pay-off college loans shorter and read thanks to our very own tips to your mortgage consolidation, refinancing, and finding out and therefore funds to pay back earliest.You would like a great deal more ideas to repay the student education loans as quickly you could? Listed below are some these types of eight creative a method to repay pupil obligations prompt.

Нет Ответов