- What is actually an enthusiastic HFA loan?

- Exactly how HFA finance performs

- Benefits

- Compare to almost every other mortgage choice

- Simple tips to use

User hyperlinks toward issues on this page come from couples one make up all of us (look for all of our marketer revelation with these list of people to get more details). However, our viewpoints are our own. See how i price mortgage loans to loans Bow Mar type objective feedback.

- HFA financing are a very reasonable sort of home loan provided by county casing loans businesses.

- This type of money often feature low-down costs, below-field mortgage costs, and you can grants or other types of advice.

- Very HFA fund feature income limits and want a decent credit score.

To have hopeful homebuyers that have straight down income and you can little coupons to own an effective down-payment, to-be a resident can seem way to avoid it of visited. Thank goodness, there are a number of software offered that will generate to shop for a property less expensive. Of numerous states bring this type of advice in the way of HFA finance.

While you are hoping to purchase a house one day however, commonly yes you are able to afford it, a keen HFA financing may help you achieve your objective.

What exactly is an HFA mortgage?

To not ever feel mistaken for the widely used FHA financing, a construction fund agencies financial, otherwise HFA loan, is a kind of mortgage aimed toward basic-some time reasonable-to-middle-income group homebuyers.

Function of HFA money

These money arrive as a result of property finance enterprises, which can be state-affiliated groups that give reasonable housing getting citizens and renters from inside the the latest communities they suffice.

Exactly how HFA finance functions

The principles up to who will score an enthusiastic HFA loan and exactly how to try to get you to definitely are different with respect to the condition you’re in. If you wish to be aware of the certain assistance to suit your state’s HFA loan program, check out that agency’s website. Here are some standard items you should expect.

The applying processes

You’ll not submit an application for a keen HFA financing in person through the agencies that administers the application form. Rather, you are able to work with an approved mortgage lender.

When you are already handling a loan provider, you could ask when they give loans throughout your state’s HFA. Such as, Flagstar Bank lovers that have HFAs in a number of some other claims to offer HFA funds. Their country’s HFA will also have a list of accepted loan providers into their site.

Being qualified to have an HFA loan

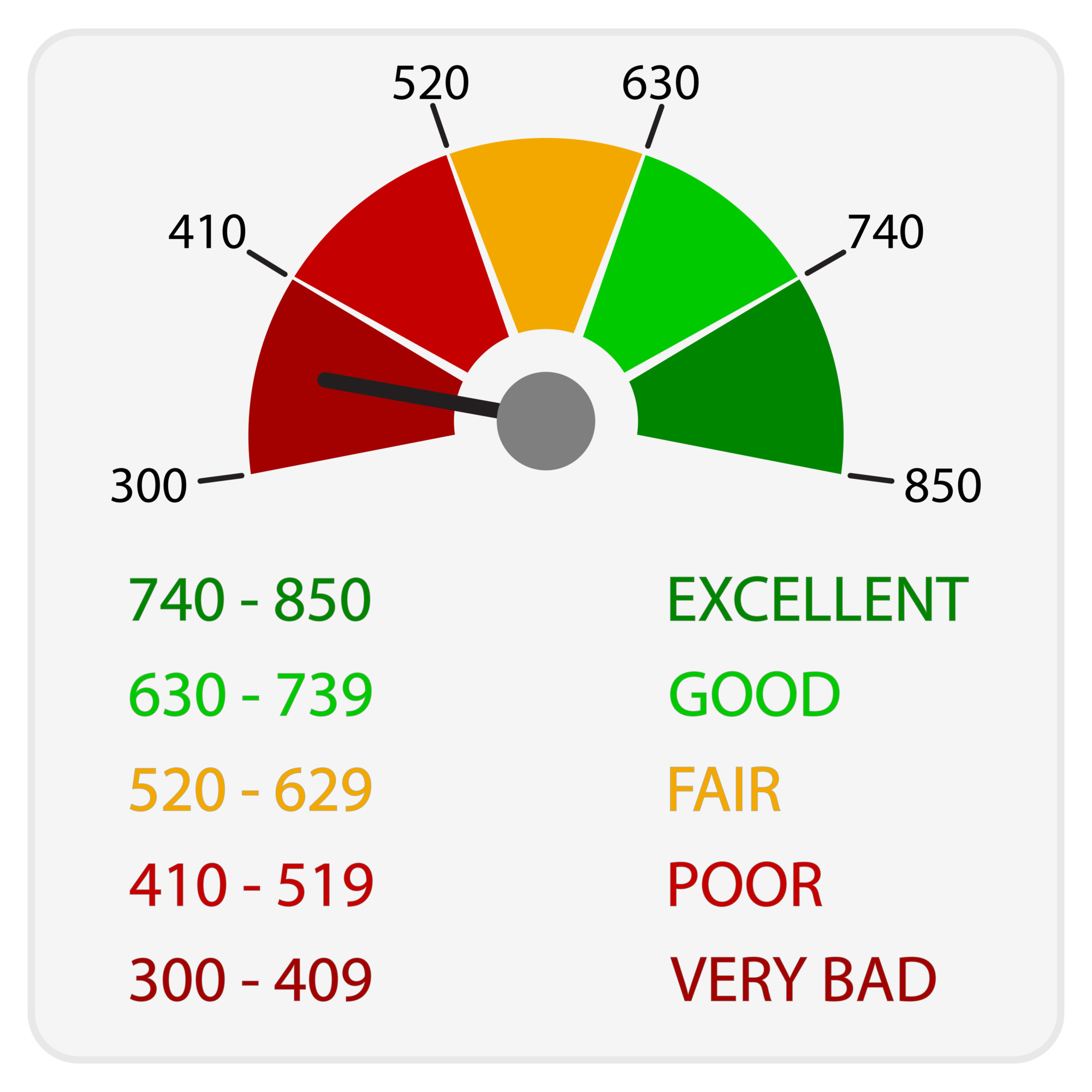

HFA money commonly want borrowers getting good credit results, usually off 620 or even more. You may want to have to take a great homebuyer knowledge course.

According to system, you may have to becoming a first-date homebuyer or be to buy inside the a particular urban area while a duplicate buyer. Each HFA set its very own income restrictions for those fund. It may lay just one limit money restrict or set limitations based on domestic size otherwise condition.

You can easily simply be able to utilize an enthusiastic HFA loan to possess good no. 1 quarters. It means you simply can’t utilize it to acquire a moment family or investment property.

Benefits of HFA financing

«We have been in a situation where i’ve high field philosophy, limited list, and stagnant earnings,» says Tai Christensen, co-founder and you will president away from down payment assistance vendor Appear House.

Since home prices have raised, it is more challenging to purchase both upfront and ongoing will cost you regarding owning a home. But HFA finance tends to make these two costs much more in balance.

Low down money and you can advice apps

Christensen states your deposit is the biggest burden to help you homeownership for most individuals. The support you get having an enthusiastic HFA financing is treat which burden and invite you to save your currency some other family-relevant will cost you.

Нет Ответов